Apple announced better-than-expected results for its second fiscal quarter. Strong iPhone sales and a record-high revenue from Services fueled the growth. The company also revealed a $100 billion share buyback plan. This large buyback shows confidence despite increasing rules and market challenges worldwide.

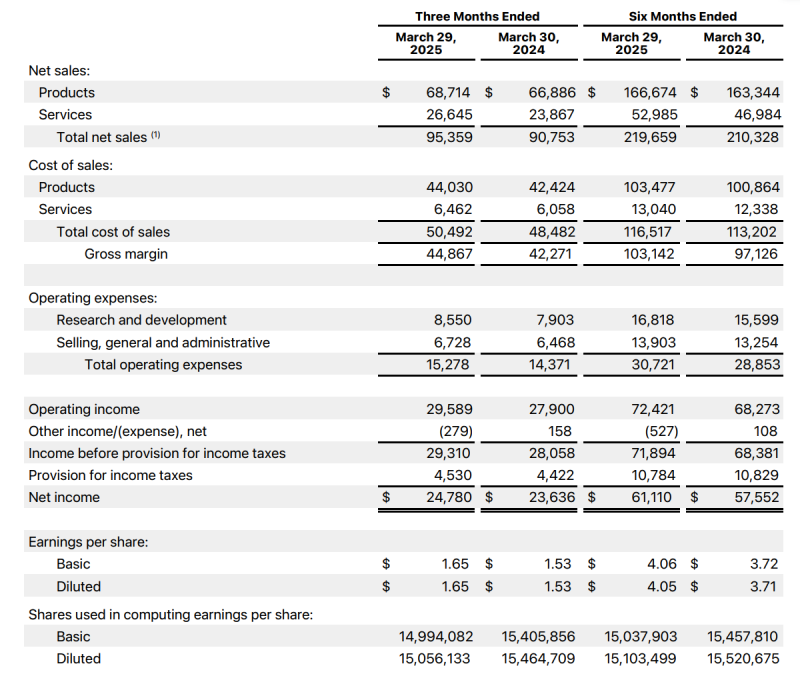

The company’s revenue reached $95.4 billion, outpacing Wall Street’s estimate of $94.6 billion. That’s a 5% rise compared to last year, even with a tough economic climate. Earnings per share came to $1.65, beating the $1.62 expected by analysts and up 8% from the same period last year.

Services Hit All-Time High

Apple’s Services segment, which includes the App Store, iCloud, and Apple Music, hit a record $26.65 billion. This is up from $23.87 billion last year. Services continue to be a strong part of Apple’s profits, especially as sales of hardware slow down.

This news comes at a delicate time. Apple faces new rules in several countries, including a plan to change its app payment policies. These rules might cut into the 30% fees it charges, possibly slowing future growth in Services. Still, Apple is holding onto its strong momentum in this area.

iPhone Sales Anchor Hardware Revenue

The iPhone sales made up the largest part of its revenue. The quarter brought in $46.84 billion from iPhones. Other device sales, like Macs, iPads, and wearables, stayed steady but did not grow much.

Growth was different across regions. Revenue went up in the Americas, Japan, and Asia-Pacific. But it stayed the same in Europe and China. Currency issues and new rules played a part in these differences.

Shareholders Get a Massive Payout

Apple also increased its quarterly dividend by 4%, now set at $0.26 per share. The payout will happen on May 15. The biggest news was the company’s plan to buy back $100 billion worth of its stock. This is one of the largest buyback programs done by a company so far.

Chief Financial Officer Kevan Parekh emphasized the company’s strong operational position:

Our March quarter performance drove EPS growth of 8% and $24 billion in operating cash flow, allowing us to return $29 billion to shareholders this quarter.

For more daily updates, please visit our News Section.